All permanent SAP Ireland Employees and employees on SAP Ireland fixed term contracts greater than 12 months.

If your hiring date is prior to January 1st 2016, you are automatically enrolled for the core level of contribution of 4% of base salary. If you wish to opt out of core level benefit or increase your own AVC contribution you can do this in the benefits tool during enrolment period.

If you are away during enrolment period please raise an HR ticket with your decision along with your other benefit choices for the following year. If your decision is to opt out please state this in the ticket. If your decision is to change contribution or if you wish to make an Additional Voluntary Contribution (% of basic salary) please indicate the percentages accordingly.

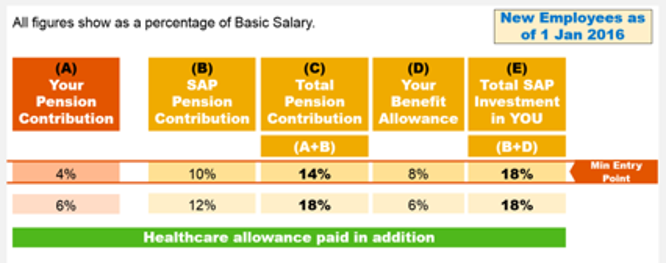

New hires and International Transfers with hiring date after January 1st 2016 will be invited to make their choices shortly after joining and will have a minimum mandatory pension contribution of 4% Employee and 10% Employer.

Note for HRdirect: For any tickets from employees who are away during enrolment or any further questions please forward to TR EMEA.

New hires and International Transfer will be invited to enrol shortly after joining, with their choices effective from the date of hire.

Existing employees can review and change their benefit selections during the annual enrolment in December every year.

Your Pension contributions made will be valid until you request a change.

If your hiring date is prior to January 1st 2016, you are automatically enrolled for the core level of contribution of 4% of base salary.

If you wish to opt out of core level benefit or increase your own AVC contribution you can do this in the benefits tool during enrolment period.

New hires and International Transfers with hiring date after January 1st 2016 will be invited to enrol shortly after joining and will have a minimum mandatory pension contribution of 4% Employee and 10% Employer.

Each December during annual enrolment period, you will have an opportunity to make changes.

Whilst you are still employed by SAP Ireland, you are unable to claim a cash withdrawal from your pension fund arrangements with SAP. This option only becomes available to a pension scheme member who has left employment with SAP Ireland and who has been contributing to their pension fund for less than 2 years.

The amount that you can contribute to your pension on a tax free basis is governed by the Irish Revenue Commissioners. For 2016 the maximum pension contribution which qualifies for tax relief are:

- Up to age 30 <> 15% of earnings*

- 30-39 <> 20% of earnings*

- 40-49 <> 25% of earnings*

- 50-54 <> 30% of earnings*

- 55-59 <> 35% of earnings*

- 60+ <> 40% of earnings*

*Earnings is defined as income from employment is and limited on earnings up to €115,000.

P: For any further questions please forward to E TR EMEA.

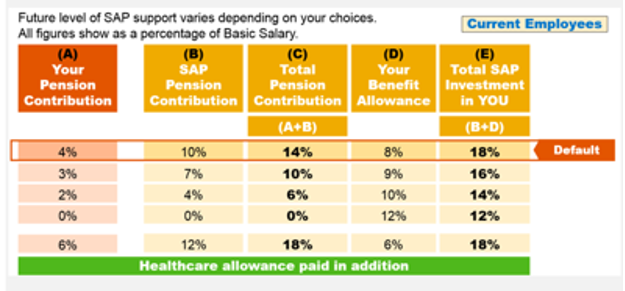

SAP makes an employer contribution depending on the employee contribution to pension plan.

For employee with hiring date earlier than January 1st 2016, Employer default contribution is 10% but can be higher or lower depending on the selection done by employee according to the below table.

If employees decide to opt out of pension (only applicable to employees hired pre 1st January 2016) there is no Employer contribution to pension Plan.

For new hires and International Transfers since January 2016, there is a minimum mandatory pension contribution of 4% Employee and 10% Employer. Employee can decide to increase contribution but can’t opt out.

Outside of the annual enrollment, you cannot adjust the amount you are contributing to your pension once selected. Changes to your contribution amounts can only be made during the annual benefit enrollment cycle.

As an SAP pension member, you can make a once-off additional voluntary contribution (AVC) to your pension in March when Bonus pay-out is received by eligible employees. The purpose of this once-off AVC is to give you the opportunity to further invest in your pension scheme and your future. This once-off AVC will have no effect on your regular employee contributions. In line with other AVCs, the contribution is PAYE exempt, although PRSI and USC will still be payable.

The window for submitting your decision will be informed by email to all employees. To make your decision you need to enter in the AVC amount you wish to make via the Aon Hewitt SAP Ireland Pension website. If you have forgotten your details please email myfutureme@aon.ie.

In order for your AVC to be reflected in the March payroll, your decision must be made and entered into the tool in advance of having final confirmation of your bonus pay-out amount. At the time of the decision window you should have an indication of your likely bonus.

You will need to enter this once-off AVC as a fixed euro amount. Please be aware that your total employee contributions in this tax year should not exceed Revenue tax relief limits. Information on these tax relief limits can be found in the slide attached. (see Forms and Templates)

Contacts: TR EMEA

Vendor Information

Email: myfutureme@aon.ie - Tel: 0818 210 285

Step 1: Getting started Log in to your Aonfocus website: www.aonfocus.ie

If this is your first time visiting the site you will need to Register as a new user. Navigate to the My Pension section of the site and select Single AVC Payment or select the Do More button on the Dashboard.

Step 2: Make a single AVC payment in the box. Remember to input whole amounts with no commas or spaces e.g. ‘500’. A single AVC payment refers to a non-recurring payment or once off payment.

Step 3: Submit it. SAP will deduct this AVC amount in the March 2020 payroll.

Should you have any queries, please contact your dedicated Aon team.

Yes, you may change your fund choices during the year via the Aon Hewitt SAP Ireland website. If you need to request logins please email myfutureme@aon.ie.

If you do not request to make any changes then your investment choices will stay the same as the previous year. Changes to fund choices can be requested through the Aon Hewitt SAP Ireland Pension Scheme.

If you know you will be out of the office during the enrolment period, and you want to increase your contribution to pension over the core arrangements or opt out, please raise a ticket with HRdirect to state what your contribution %age is to be over the core level are or your decision to opt out.

Yes, in most cases we can arrange for your pension from a previous employer in Ireland to be transferred to your pension with SAP. You will need to contact the administrator of the previous scheme and ask them to send you a leaving option statement. This statement will contain paperwork that you will need to complete and return to them to initiate the transfer. You will need to contact Aon Hewitt on 0818 210 285 or myfutureme@aon.ie to obtain the relevant information in relation to the SAP Ireland Pension Scheme so that it can be determined whether the transfer can proceed.

You can view your pension fund details online on at www.aonfocus.ie.

If you leave with less than 2 years service as a member of the scheme you can:

- Transfer your retirement account to the Pension plan of your new employer or

- Transfer your retirement account to an insurance company pension bond in your own name or

- Take a refund of your contributions, less tax at a rate of 20% or

- Leave your retirement account invested in the plan

If you leave with more than 2 years service as a member of the scheme you can:

- Transfer your retirement account to the Pension plan of your new employer or

- Transfer your retirement account to an insurance company pension bond in your own name or

- Leave your retirement account invested in the plan

Further questions on leaving SAP and your pension should be addressed to our pension administrators Aon Hewitt.

myfutureme@aon.ie - Tel: 0818 210 285

You can only opt out during annual enrolment window (specified period in December every year) only if your hiring date is prior to January 1st 2016. If you miss this window, you will stay in the pension scheme until end of the following year and you can amend the choices during annual enrolment of the following year.

If you are a New hire or International transfer employee with start date on January 1st 2016 or later, you are not able to opt out of pension as there is a minimum mandatory pension contribution of 4% of base salary from employee and 10% from Employer.

Please reach out to Aon Hewitt – via email myfutureme@aon.ie or telephone 0818 210 285.

Please log a HRdirect ticket will be forwarded to the Functional Team that will notify AON of your change of address. Could you please confirm which is your new address?